It seems that 2021 will be dominated by two key themes: green investing and the fear of runaway inflation. The two themes may be linked, with a two-year surge in investment being partly to blame for the simultaneous increase in both prices and wages.

A connection between ESG investment and inflation could come from three factors:

Decreased Capex in oil and gas, caused by lower institutional capital allocation to oil and gas companies

Increased wages, in part to meet social commitments

Competition for ‘green’ raw materials (such as Cobalt and Lithium)

Oil and Gas Capex

Capex of Oil and Gas companies fell again in both 2020 and 2021 even with a recovering Brent price. Likely this is due a to host of factors but the long-term viability of the oil-economy must be the most important, closely followed by the cost of capital for oil and gas companies.

Long term viability of oil extraction is threatened by broad, international plans for decarbonisation and by specific national plans such as the UK Government’s intention to stop the sale of new petrol cars.

Cost of capital is extremely multi-faceted but it seems plausible that a move towards ‘green’ bonds and funds which tend to divest from Oil and Gas products - may have pushed up the price of credit in the sector.

In addition, oil and gas companies have been forced by activist investors to internally reallocate capital to new, environmentally-friendly, projects.

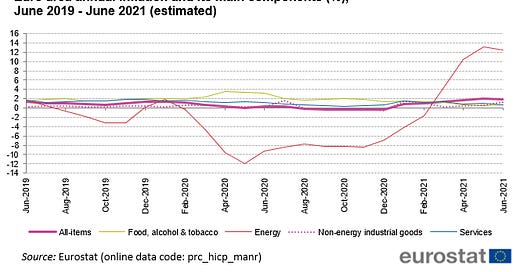

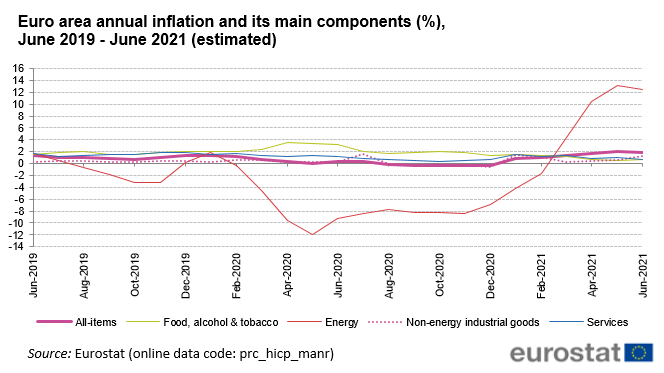

With energy being the overriding driver of inflation in both the Eurozone and the US, it seems highly likely that falling Capex is leading to both medium and long term increases in energy prices.

Increased Wages due to social pressure

Wages have risen through 2020 and 2021 for a variety of reasons - likely driven by a broad labour shortage in service roles in the US and generous furlough programs in the UK and EU.

In addition, we have seen large multinationals (who just happen to be contending with embolden and enriched ESG investors) also raising wages at the same time.

Amazon have committed to a wage increase worth billions of dollars, as have Morrisons, MacDonalds, Chipotle and more. Amazon is a major holding in numerous ESG ETFs and alternative investment funds due to its relatively low carbon footprint and Morrisons has also been the target of active ESG investors in recent years.

Most likely, ESG pressures will be a side-show to a tightened labour market from other pandemic-related factors (people switching jobs, leaving urban areas and workers taking early retirement).

While correlation does not equal causation, this is a little too convenient and perhaps ESG investors are being alloyed through high-profile wage increases. These wage increases may be in place of other strategies to attract workers with companies figuring that they can attract and retain staff while pleasing investors both at the same time.

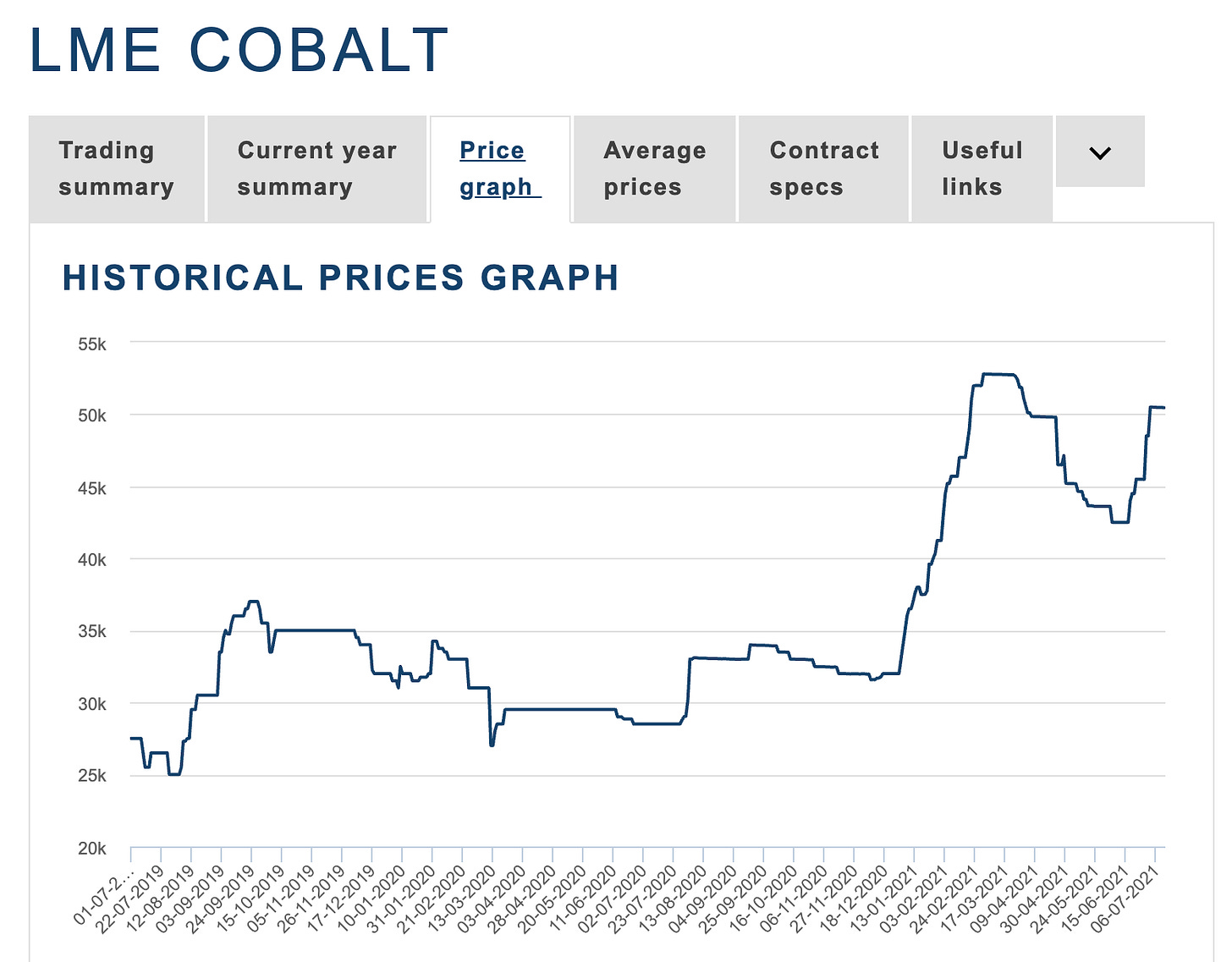

Competition for ‘green’ raw materials

The Economist wrote a comprehensive piece covering the scramble for raw resources needed to decarbonise economies - all driven by in-flows towards the ESG investment space.

The prices of metals like Cobalt, Nickel, Neodymium and more have rumbled up throughout 2019, 2020 and 2021 - due to their essential role in electric motors, generators and in energy storage.

It is unlikely these increases in commodities prices will automatically feed back into the labour market, although the economist estimates that the raw material cost of electric cars and generation has gone gone up by 139% in the last year. With electricity prices climbing and electric cars becoming a greater share of the market - it seems that ESG-investment may continue to drive inflation for the time being.